Now Reading: Parliament Approves New Income Tax Bill, Replacing 60-Year-Old Law

1

-

01

Parliament Approves New Income Tax Bill, Replacing 60-Year-Old Law

Parliament Approves New Income Tax Bill, Replacing 60-Year-Old Law

Quick summary

- On August 12, 2025, Parliament passed the Income Tax Bill, 2025 to replace the Income Tax Act of 1961, effective from April 1, 2026.

- The new Bill simplifies language by reducing sections from 819 to 536 and chapters from 47 to 23. Word count is now trimmed from over five lakh words to about two lakh words.

- The law introduces tables (39) and formulas (40) for better readability. It does not impose any new tax or increase rates.

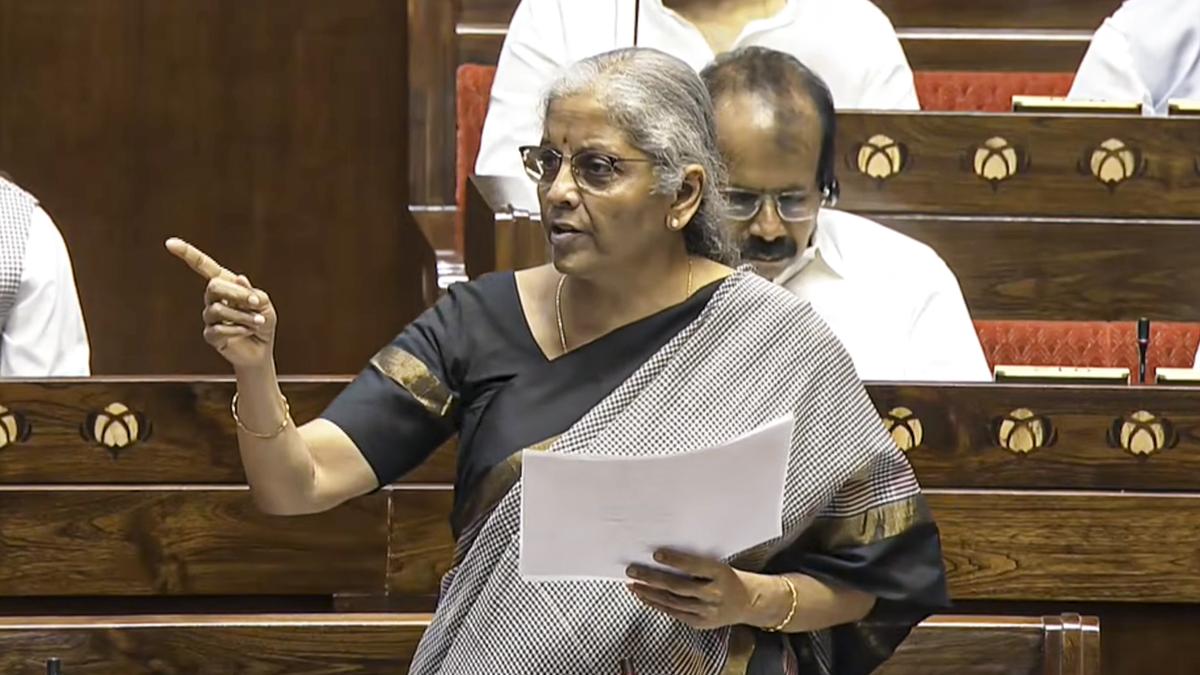

- Finance Minister Nirmala Sitharaman stated that Prime Minister Modi instructed no additional tax burden on citizens post-COVID era. She described the Bill as taxpayer-friendly and a “milestone” for financial clarity in India.

- Despite prior agreements for debate, opposition parties staged a walkout demanding voter list revision discussions for Bihar instead of participating in deliberations on the Bill in Rajya sabha.

- Crafted within six months with around 75,000 work hours allocated by officials; FAQs and simpler rules will be issued soon alongside computer system updates at IT-department level required before implementation begins April next year (2026).

Indian Opinion Analysis

The passing of the Income Tax Bill represents a momentous effort toward simplifying India’s complex taxation framework after six decades under outdated laws-an essential reform considering evolving economic structures and digital transition needs in governance globally.This rewrite could boost citizen trust even productivity indirectly attempt easy clear bases/tasks rollout

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

Loading Next Post...