Now Reading: Tesla’s 2025 CEO Pay Package: Could Legal Challenges Arise?

-

01

Tesla’s 2025 CEO Pay Package: Could Legal Challenges Arise?

Tesla’s 2025 CEO Pay Package: Could Legal Challenges Arise?

Quick summary

- Tesla has shifted its incorporation to Texas, aligning its laws with the state for executive compensations.

- Texas laws require shareholders to hold at least 3% of outstanding shares to sue over pay packages, making shareholder litigation more challenging for retail investors.

- Litigation risks in texas are further reduced by removing jury trials in business disputes and using specialist courts rather.

- Delaware recently passed new legislation (SB21) restricting shareholder litigation over CEO pay packages. Exceptions remain for breaches of fiduciary duty or bad faith.

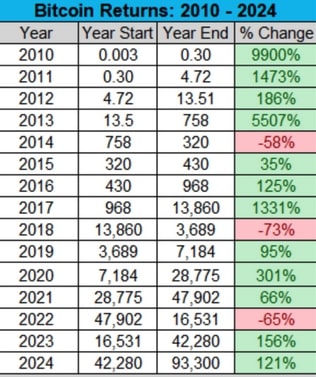

- Delaware’s actions aim to retain tech companies after shareholder suits challenged large CEO compensation packages like Tesla’s $56 billion 2018 plan, which was voided twice by courts despite two ratification votes by Tesla shareholders.

- Tesla appealed the 2018 package ruling to the Delaware Supreme Court; oral arguments are set for October 2025. Mixed predictions exist about whether the ruling will be overturned.

- Pending appeal outcomes, Elon Musk received an interim $29 billion compensation package approved in August 2025-50% less than the rescinded plan value.If Delaware overturns prior rulings, Musk coudl receive all assets from the original package.

Indian Opinion Analysis

Tesla’s relocation and adoption of Texas legal thresholds highlight ongoing tensions between corporate governance and shareholder protections. This shift significantly curtails ordinary investors’ ability to seek legal recourse on executive compensation decisions-a move that critics might view as favoring corporate management over accountability. Conversely, states competing legislatively (Texas and Delaware) show how tech companies can reshape regulatory environments to suit their operations.For India, these developments underscore implications around balancing policy frameworks when attracting or retaining multinational enterprises. Indian regulators may need to evaluate similar dynamics between fostering industry growth vs assuring equitable stakeholder oversight in sectors involving global firms like technology or automotive giants.

India’s continued enforcement of regulations promoting clarity could distinguish it as a destination where governance aligns more closely with investor expectations-beneficial amid shifting perspectives globally on corporate self-regulation.