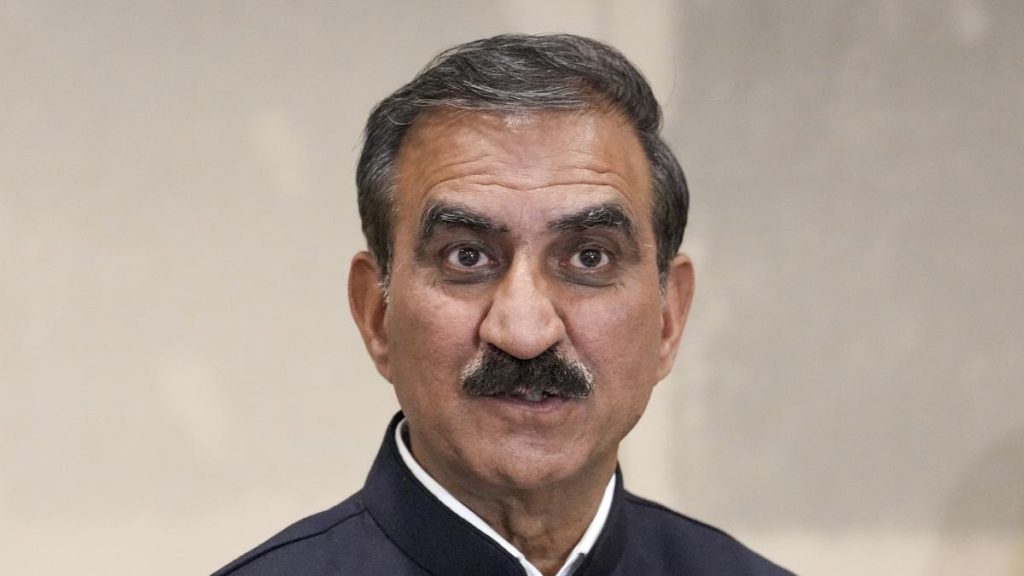

Now Reading: India Considers Block on IMF Funds for Pakistan Amid Economic Strain

-

01

India Considers Block on IMF Funds for Pakistan Amid Economic Strain

India Considers Block on IMF Funds for Pakistan Amid Economic Strain

Fast Summary

- IMF Meeting: The IMF Executive Board will convene on May 9 to discuss a $7 billion loan proposal for pakistan amidst heightened India-Pakistan tensions following the Pahalgam attack.

- India’s Potential Vote Against Approval: historically abstaining from voting,India may oppose pakistan’s loan considering allegations of terrorism support. the Pahalgam terrorist attack killed 26 people, with The Resistance Front claiming responsibility.

- India’s Influence in IMF: India has a voting share of 2.36%, insufficient to singularly block the proposal but may seek support from countries like the US (16.5% share) and Japan (6.1% share).China’s 6.09% vote presents challenges as it traditionally supports Pakistan.

- economic Fallout on Pakistan: Ongoing economic struggles include soaring inflation (~10%-12%), depleting foreign reserves, unemployment at 5.7%, and severe food shortages leading to public unrest.

- Geopolitical Shift through FATF?: Analysts suggest India’s stance could also push for Pakistan’s re-enlistment into the gray list of the financial Action task Force (FATF). FATF policies considerably affect access to global funding agencies like IMF and World Bank.

Indian opinion Analysis

The upcoming decision by India concerning Pakistan’s loan plea signals broader geopolitical strategies tied closely with counterterrorism allegations post-Pahalgam attack-a notable turning point after years of abstentions in such votes.

While India’s individual voting stake in IMF remains limited at 2.36%, potential alliances with larger shareholders such as the US or Japan could amplify outcomes against approval, indirectly supporting its longstanding diplomatic stance against terrorism-linked economies.

India’s approach can reverberate across multilateral platforms like FATF by pressuring accountability measures around money laundering or terror financing linked actors in Pakistani territory-potentially impacting future funds accessibility globally for Islamabad.

If carried forward tactically yet neutrally focused rather solely revenge-driven planning – better ripples among international layers economic governance dependent multilateral transparent priorities contribute dialogues cooperative shared financial future.