Now Reading: Property Deals: Sub-Registrars to Notify Income Tax Department

-

01

Property Deals: Sub-Registrars to Notify Income Tax Department

Property Deals: Sub-Registrars to Notify Income Tax Department

Fast Summary

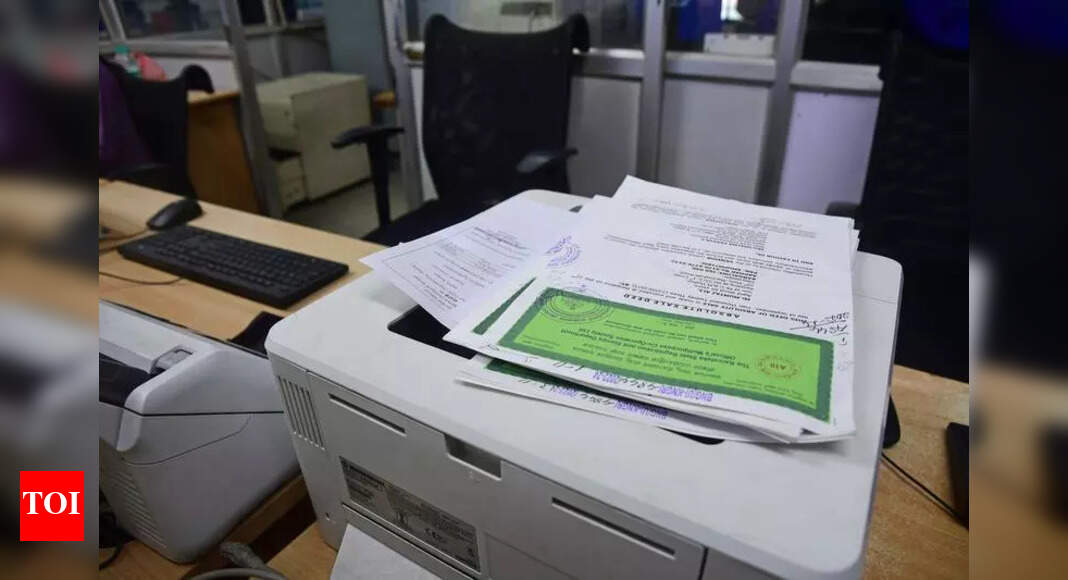

- The Karnataka Stamps and Registration Department issued a circular mandating sub-registrars to collect the Specified Financial Transaction (SSFT) statement for property transactions above ₹30 lakh.

- This directive aligns with Section 285BA(1) of the Income Tax Act, 1961, aimed at preventing tax evasion.

- Required information includes PAN details, Aadhaar numbers, transaction specifics (value, method), buyer and seller addresses, contact details, birth dates, Form 60 receipts (if applicable), and email IDs.

- Documentation will not be finalized until SSFT forms are submitted alongside registration documents. Sub-registrars failing compliance face accountability measures or disciplinary actions.

- heavy workloads among sub-registrars have led to gaps in reporting these transactions in the past according to officials. Some suggest integrating SSFT submissions into Kaveri 2.0 software to streamline procedures digitally.

!Buying or selling property? Sub registrars inform income tax departments

Indian Opinion Analysis

The circular marks an crucial step toward ensuring financial transparency in property transactions exceeding ₹30 lakh by mandating direct communication between sub-registration offices and the Income Tax Department via SSFT forms submission. While this addresses concerns about potential tax evasion raised previously by authorities, it also imposes significant administrative responsibilities on sub-registry offices already burdened with heavy workloads.

Integrating digital tools like Kaveri 2.0 for streamlined submission processes is a pragmatic path forward suggested by impacted officials themselves-it may reduce errors and ensure smooth compliance in high-value property deals while easing bureaucratic pressure.

Ultimately,these directives reinforce India’s effort toward creating a more robust regulatory framework around real estate taxation-a sector often scrutinized for opaque dealings-and reflect broader positive outcomes in governance through digitization initiatives aimed at improving efficiency across public systems without compromising accountability mechanisms.