Now Reading: AI Agents Like ChatGPT Poised to Revolutionize Online Shopping

-

01

AI Agents Like ChatGPT Poised to Revolutionize Online Shopping

AI Agents Like ChatGPT Poised to Revolutionize Online Shopping

Quick Summary

- AI agents, such as ChatGPT Operator, are being developed to assist users with tasks beyond simple Q&A, including shopping and coding.

- Major payment providers like Mastercard, Visa, and PayPal are introducing technologies that enable AI agents to securely handle full shopping experiences-from browsing products to completing purchases.

- Mastercard launched its Agentic Payments Program called “Agent Pay,” integrating conversational commands and tokenized payment credentials for secure transactions. Collaborative efforts involve Microsoft.

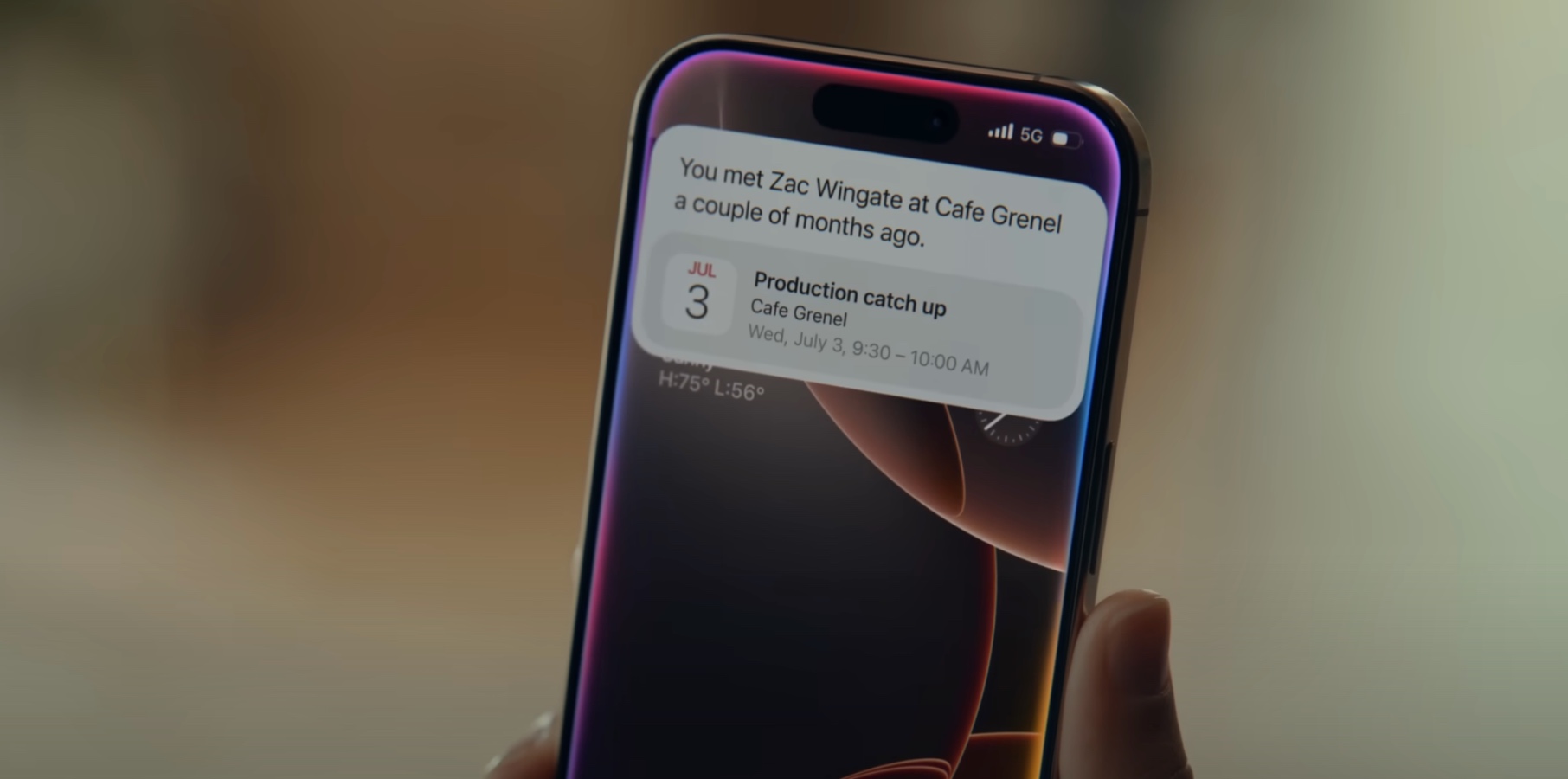

- visa unveiled “Visa Intelligence Commerce,” featuring budget-setting tools, secure tokenization for payment authorization by AI agents, partnerships with OpenAI and others, using real-time monitoring to ensure control over transactions.

- PayPal introduced tools like Agent Toolking for managing checkout processes in an AI-driven commerce setting. Google also added tighter integration of AI into its shopping features.

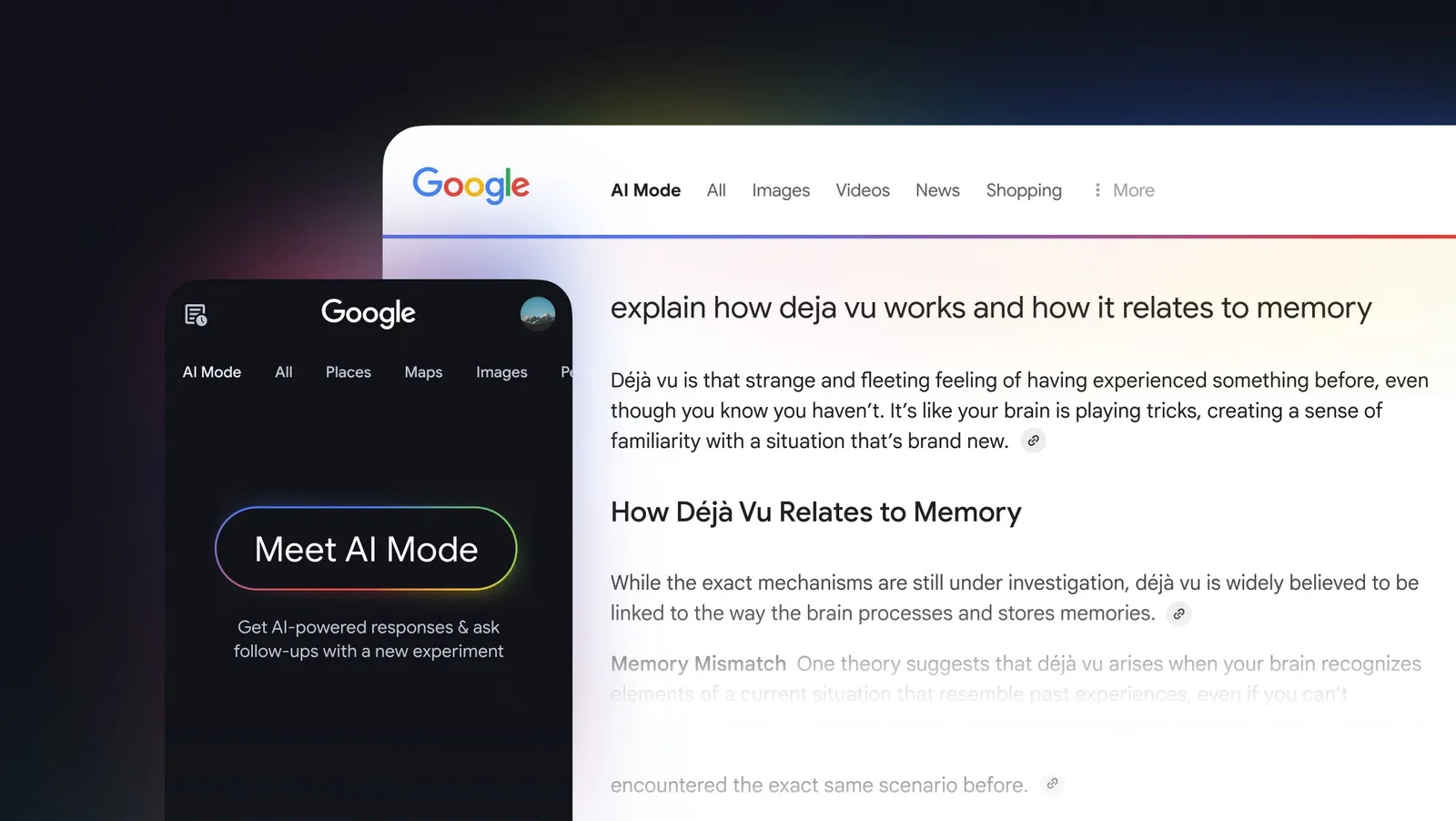

Images:

!Visa example: Travel arrangements

!Budget settings via Visa

Indian Opinion Analysis

Teh introduction of agentic payments by Mastercard and Visa-and the accompanying support from global tech leaders-represents a significant technological shift toward automating consumer experiences via AI tools like ChatGPT operators. For India-a rapidly digitizing economy-such advancements could accelerate e-commerce penetration while simplifying financial access for individuals unfamiliar with conventional banking systems or struggling with informational barriers during online purchases.

Though, implementing such agent-driven systems in India will require addressing multiple challenges including cyber security concerns amidst growing fraud incidents and ensuring inclusivity across diverse socio-economic backgrounds that lack digital literacy or trust in automated services powered abroad.

While token-based protection mechanisms announced by these companies sound robust on paper-they might need adaptation given India’s scale where regulatory compliance under frameworks like NPCI’s oversight remains paramount contextually alongside rollout transparency aligning rural intermittency