Now Reading: Blue Guardian 2023 Review: Rankings and Insights by Dumb Little Man

-

01

Blue Guardian 2023 Review: Rankings and Insights by Dumb Little Man

Blue Guardian 2023 Review: Rankings and Insights by Dumb Little Man

Quick Summary

- blue Guardian Overview: A forex proprietary trading firm offering funded accounts via a two-step evaluation process to identify skilled traders.

- evaluation Process: Phase 1 spans 40 days; Phase 2 lasts 80 days. Successful participants can earn up to an 85% profit share and access scaling plans for account balance increases.

- Features & Benefits: Generous profit-sharing, flexible trading hours, clear fee structure, advanced risk tools, and bi-weekly payment options available. Drawbacks include low crypto leverage, costly elite accounts, and lack of phone support.

- Customer Satisfaction: Holds a 4.8-star rating on Trustpilot; users praise responsive customer support and quick payouts but also report concerns over drawdown limits and account management issues.

- Fees & Withdrawal Options: Fees vary by chosen funding level but are refundable upon passing the trading challenge.Withdrawals have no minimum or maximum limits with applications processed in hours using bank cards, e-wallets, or crypto wallets.

for further details on Blue Guardian’s offerings: Read More

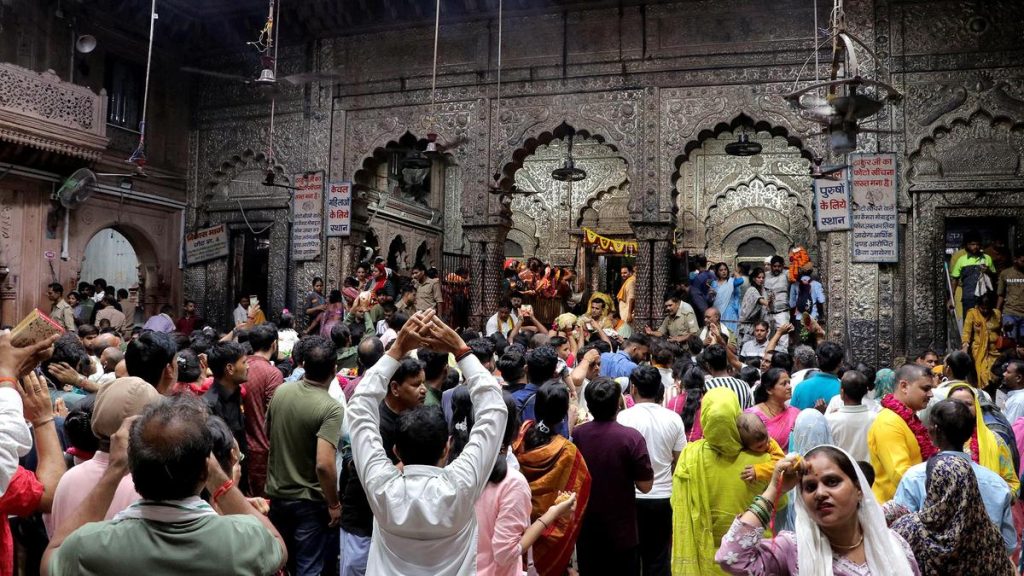

Indian Opinion Analysis

While Blue Guardian caters primarily to forex traders globally with limited emphasis on geographic regions like India specifically mentioned in the article, its model may indirectly be meaningful for Indian traders seeking professional growth through prop firms like this one amid rising interest in alternative career paths such as financial markets.

India has a vast pool of talented individuals transitioning into tech-driven industries such fintech increase It.! platforms At problem cost affordability improvements setup prop businesses boost