Now Reading: Centre Hikes Excise Duty on Petrol, Diesel by ₹2/Litre

-

01

Centre Hikes Excise Duty on Petrol, Diesel by ₹2/Litre

Centre Hikes Excise Duty on Petrol, Diesel by ₹2/Litre

Updated April 7th 2025, 16:37 IST

While the notification does not specify the impact on retail prices, industry insiders suggest that fuel prices at the pump are unlikely to change.

Govt Hikes Excise Duty By Rs 2 Each On Petrol And Diesel

| Image:

Pixabay

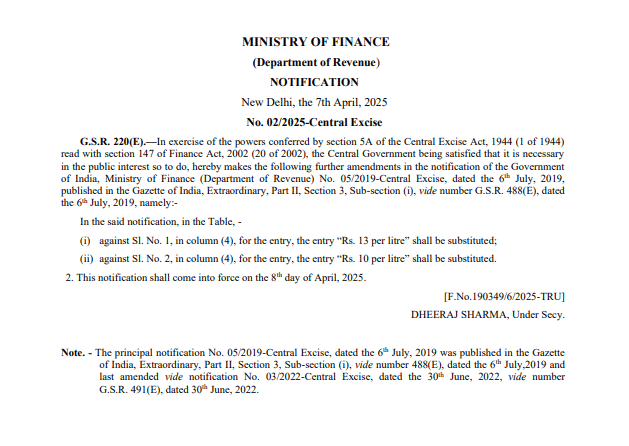

New Delhi: In a move that may raise eyebrows but not fuel bills — at least for now — the central government has increased the excise duty on petrol and diesel by ₹2 per litre. While the hike, effective April 8, 2025, is expected to generate additional revenue for the exchequer, it is unlikely to affect retail prices at the pump. According to a Finance Ministry notification, the excise duty on petrol has been raised to ₹13 per litre and on diesel to ₹10 per litre.

While the notification does not specify the impact on retail prices, industry insiders suggest that fuel prices at the pump are unlikely to change. The higher excise duty is expected to be offset by recent declines in international crude oil prices, which would have otherwise led to a reduction in retail fuel prices.

As a result, oil companies are expected to absorb the impact of the duty hike, taking a hit on their margins instead of passing on the cost to consumers.

“PSU Oil Marketing Companies have informed that there will be no increase in retail prices of petrol and diesel, subsequent to the increase effected in Excise Duty Rates today”, the Petroleum and Natural Gas Ministry said.

Excise Duty on Fuel

Excise duty on fuel is a form of indirect tax levied by the central government on the manufacture or production of goods within the country—in this case, petrol and diesel. It’s collected by the government from oil marketing companies (OMCs) at the point of production or import, and it forms a major source of revenue for the Centre.

Excise duty is imposed before the fuel reaches petrol pumps.

It is included in the final retail price that consumers pay.

The tax is fixed per litre, not a percentage—e.g., ₹13/litre on petrol or ₹10/litre on diesel.

This means even if international crude prices fall, the excise duty component remains unchanged unless the government revises it. It’s different from state-level VAT, which varies by state and is charged as a percentage of the fuel price.

In December 2024, the government scrapped the windfall tax on domestically produced crude oil and fuel exports as global oil prices continued to decline.

Published April 7th 2025, 15:27 IST