Now Reading: Converting Transportation and Labor into Products and Profits Creates Insane Stock Values

-

01

Converting Transportation and Labor into Products and Profits Creates Insane Stock Values

Converting Transportation and Labor into Products and Profits Creates Insane Stock Values

Cern Basher is wealth manager of billions and he explains capitalization. At its core, capitalization is the process of transforming everyday human activities—often free, informal, or unmonetized—into structured, scalable businesses that generate recurring revenue, attract investment, and build massive shareholder value.

It is not just about creating a product. It is about value capture of a major human activity and dding perceived value through branding, efficiency, or technology, and then listing it on public markets where it can compound through multiples of earnings.

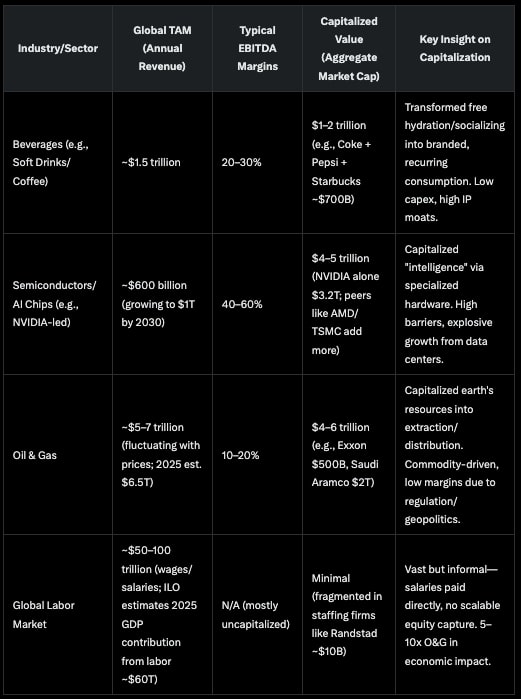

Consider hydration or drink which is a basic human need. For millennia, people drank water from streams, wells, or simple vessels—zero capital market value. Then came industrialization and marketing: Bottled water brands like Evian or Dasani turned it into a convenience product. But the real leap was in flavored, caffeinated, or experiential drinks. Coca-Cola, invented in 1886 as a medicinal tonic, has evolved into a $300 billion+ market cap behemoth. Their secret? Not just the formula, but capitalizing on global distribution, branding, and consumer habit formation. Annual revenues exceed $45 billion, with EBITDA margins around 30%, turning a penny-per-unit commodity into a high-margin part of lifestyle.

Same thing for Starbucks. People were doing and using things for free or in an untracked and informal way but then they are convinced and happy to pay $1 to $10 per cup of bottled or canned product liquid.

Starbucks takes this further by capitalizing the social ritual of coffee consumption. Pre-1971, coffee was a home-brewed or diner staple, often costing pennies. Howard Schultz’s vision productized it as a “third place” experience—premium beans, ambiance, and personalization. Today, Starbucks is over $110 billion market cap, with $36 billion in annual revenue and 25%+ EBITDA margins. Consumers happily pay $5–$10 for what was once free or cheap, creating a capitalized ecosystem of suppliers, real estate, and apps.

Basic computation was once manual or mechanical—think abacuses or punch cards, with no stock ticker attached. Then semiconductors formalized it. NVIDIA, initially a graphics chip maker, pivoted to capitalize artificial intelligence by designing GPUs optimized for parallel processing in AI training.l

Nvidia has created a business around new kinds of chips to capital intelligence and they have $99 billion of adjusted EBITDA (profit without one time charges and focused core business etc..) high growth and high margins and they have $4-4.5 trillion in valuation.

Oil and Gas is a $7 trillion industry with low margin. It is a large part of the larger energy industry.

Robotaxi and Robotrucking

Capitalizing the movement of goods (trucking) and movement of people in a far more efficient, complete high margin way (robotaxi) can have such a large projected capitalization.

Buying a truck ($150,000 for a Class 8 semi) capitalizes manufacturing at 5–10% margins (e.g., PACCAR or Daimler).

But operating it? That’s where the real value hides.Legacy Trucking: A truck logs 100,000 miles/year at $2.20/mile revenue.

Costs: $1.00–1.50/mile for fuel/labor/maintenance, yielding 30–60 cents/mile profit.

Labor alone eats 40–50% of costs ($100K+ driver salary).

Total annual profit per truck: ~$30K–60K. Scaled to a fleet, this is capitalized modestly (JB Hunt $20B market cap on $12B revenue).

Autonomous Trucking/Robotaxi Revolution: Enter Tesla, Waymo, or Aurora, capitalizing movement with AI. A robotruck could run 300,000 miles/year (24/7 ops, no fatigue).

Revenue: Still $2.20/mile, but costs drop to $0.40/mile (energy, minimal maintenance, no salary).

Profit: $1.80/mile, or $540K/year per vehicle. This means a $2 trillion in annual profit with 40 PE can become $80 trillion in capitalization.

Robotaxis extend this to passenger mobility. Pre-Uber, rides were informal (hitchhiking, taxis at low utilization). Uber/Lyft capitalized it partially ($150B combined cap), but with 10–15% margins due to human drivers. Full autonomy (e.g., Tesla’s projected 2026 rollout) could boost utilization 3–5x, margins to 50%+, creating a $5–10T TAM segment.

If autonomous vehicles capture 20% of global transport ($10T TAM), at 30% margins, that’s $600B annual EBITDA—valuable at 20x multiple = $12Trillion equity creation.

Labor is 5 to 10 times as large as oil and gas to the world economy but is almost all uncapitalized.

If one created a company that could capitalize labor even at Oil and gas industry margins then that would be a $35-70 trillion business capitalization for an automated and productized labor industry.

Humanoid bot Labor would be the automation or productization and capitalization of per hour work.

Today, global labor is ~3.5 billion workers averaging $20/hour (adjusted for PPP; World Bank data), totaling ~$60T/year. B

It is not capitalized. Wages go straight to pockets, with no equity overlay.

Humanoid robots from firms like Tesla (Optimus). These bots productize tasks like assembly, caregiving, or warehousing.

They will cost $20–200K/unit and then dropto $10K with scale.

Revenue model: Lease at $10–20/hour with 80%+ margins after software/AI layers.

Assume a bot works 8,000 hours/year (24/7 minus downtime). Revenue: $10/hour x 8,000 = $80K/unit/year. Costs: $2/hour (energy, maintenance) = $16K/year.

EBITDA: $64K/unit/year (80% margin). Deploy 1 billion bots then $64 trillion annual EBITDA.

At 40 PE that would be $2500 trillion dollars in market capitalization.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.