Now Reading: EU Plans 15% Cut in Steel Imports

-

01

EU Plans 15% Cut in Steel Imports

EU Plans 15% Cut in Steel Imports

Fast Summary

- Steel Quotas: The European Union plans a 15% reduction in steel import quotas from April to curb cheap steel inflows post-U.S. tariffs.

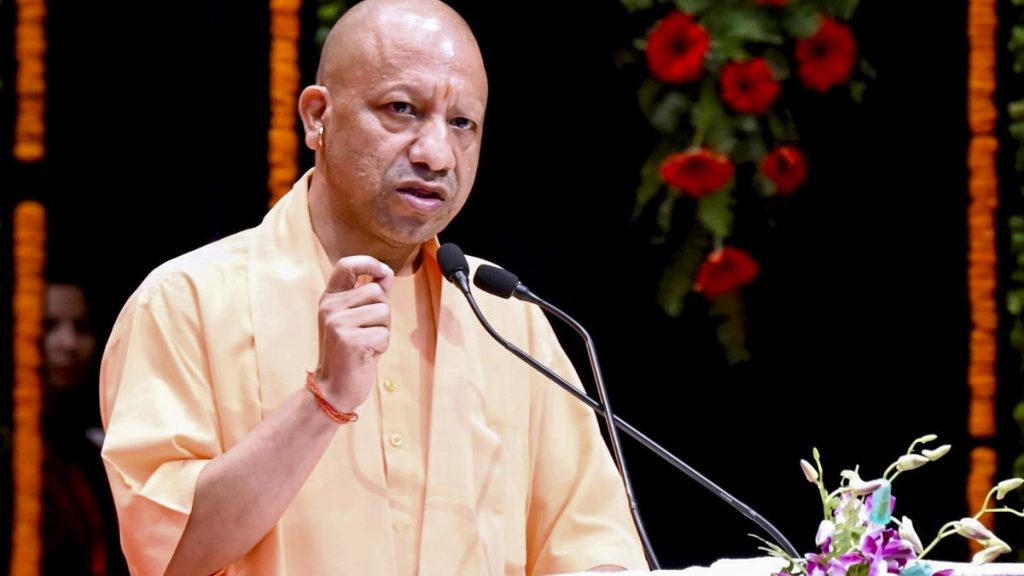

- Tariff Impact: U.S. tariffs of 25% on steel imports are prompting producers from india, Canada, and China to redirect volumes toward Europe.

- EU steel Measures:

– Safeguard quotas for multiple grades will reduce imports; steel outside the quota faces a 25% tariff.

– Public procurement rules will prioritize European steel by 2026 under a revised framework.

– A “melted and poured” rule will ensure stricter origin traceability for imported metals.

- Strategic concerns: The EU wants reduced dependency on imported steel citing its strategic importance for industries, including defense and automobiles.

- Industry Support: Other non-trade measures include long-term power guarantees through the European Investment Bank to support domestic producers.

read More: EU proposes cutting steel imports by 15%

Indian opinion Analysis

The EU’s decision to tighten import quotas could have mixed implications for India as an exporter of steel. While it signals reduced ease of entry into the European market due to heightened safeguards and preferences given to local production, it simultaneously underscores the growing competition among global exporters post-U.S.tariffs-a shift India has already been navigating.

India’s reliance on key export markets like Europe raises questions about how such policies might challenge its ambitions in manufacturing and international trade growth. Though, lessons learned here could encourage diversification toward new regions or investments made internally within value-add sectors if certain overseas opportunities narrow further.

For domestic stakeholders-both industry players monitoring global markets or policymakers creating trade strategies-this progress serves as a testament that protectionist policies abroad are reshaping pathways in bilateral/multinational relations inside competitive industrial sectors globally. ensuring adaptability appears central amidst these evolving dynamics.