Now Reading: HSBC Midcap Fund: Consistency Key to Overcoming Mixed Performance

-

01

HSBC Midcap Fund: Consistency Key to Overcoming Mixed Performance

HSBC Midcap Fund: Consistency Key to Overcoming Mixed Performance

Speedy Summary

- Fund overview: HSBC Midcap Fund, launched on August 9, 2004, is an equity-focused midcap mutual fund with Rs. 9,541 crore AUM (as of February 2025) and follows the NIFTY midcap 150 Total Return Index as its benchmark.

- Cost Details: Current NAV for growth option is Rs.338.36; IDCW stands at Rs.69.19. Minimum investment required is Rs.5,000; SIP amounts start at Rs.500 per month; Expense ratio is 1.75%. exit load of 1% applies for redemptions exceeding 10% within one year of investment duration (Data as of February/April).

- Fund Managers: Venugopal Manghat and Cheenu Gupta manage the fund with respective tenures of over one year and two years in this role.

- Portfolio Activity: Recent inclusions include Axis Bank, Mahindra & Mahindra, abbott India, Ashok Leyland (February), Kaynes Technology India (January); departure from Kalyan Jewellers India, Power Finance Corporation, REC in january.

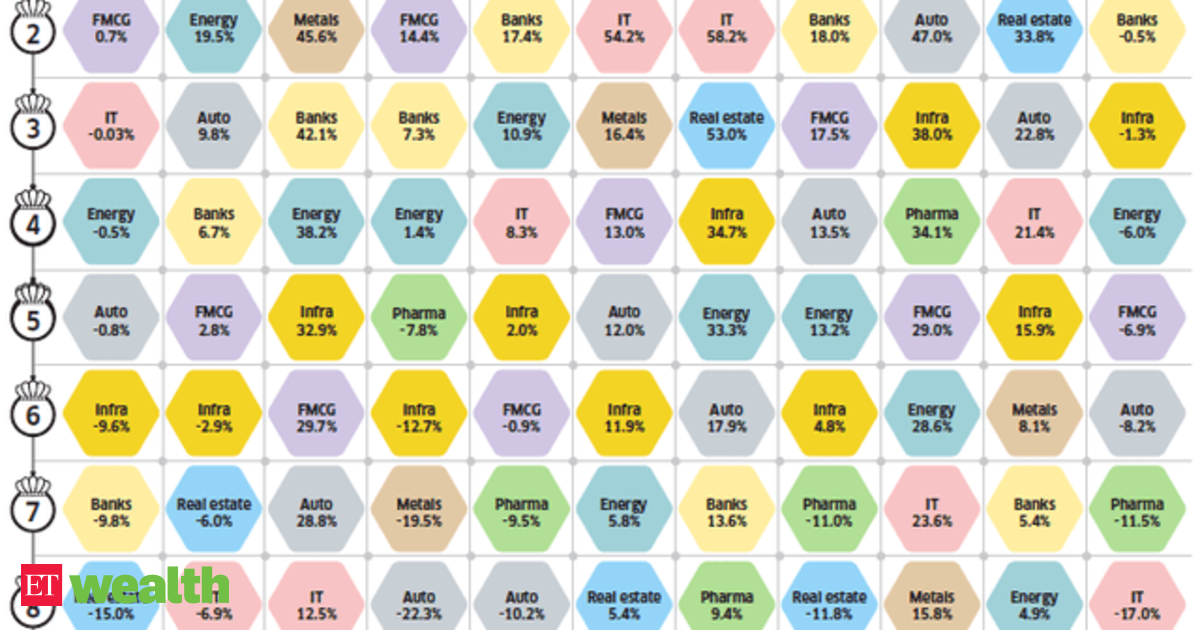

- Performance Insights: The fund adopts a diversified portfolio targeting scalable businesses with strong fundamentals while considering ESG parameters; though past performance has been inconsistent despite notable outperformance in recent times.

!Image: im-1

!Image: im-2

!Image: im-3

Indian Opinion Analysis

The HSBC Midcap Fund illustrates a strong focus on scalable businesses backed by sound management practices and financial metrics while keeping ESG parameters in consideration-a reflection of modern investment priorities geared toward sustainability alongside profitability objectives.However, erratic ancient performance raises concerns about consistent returns despite recent advancement trends indicating potential upside for long-term investors willing to wait through volatility.

Diversification seen across large-, small-, and mid-cap holdings introduces balance but may limit high-concentration strategies that could yield superior outcomes when correctly timed-a factor worth monitoring closely for informed decision-making by retail investors or seasoned stakeholders alike who wish confidence predict future results appears tied regular persistent stability adherence professional flex draft evaluations