Synopsis

Our panel of experts will answer questions related to any aspect of personal finance. If you have a query, mail it to us right away.

Getty Images

Getty ImagesI am 25 years old and in my first job. Is it wiser to buy a house early in my career or focus on building financial assets first?

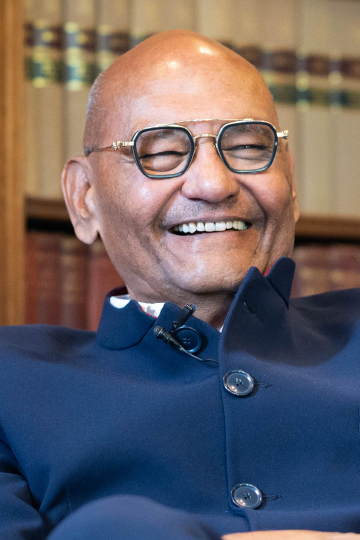

Adhil Shetty CEO, BankBazaar: If buying a house for yourself is a primary priority, then go for it, but be mindful of some challenges. First, securing a home loan may not be easy as some lenders may require two years’ continuous employment to be eligible for a home loan. Second, only a part of the cost of the house will be covered by the home loan. For instance, if the purchase price of a house is Rs 50 lakh, the actual cost of ownership, including furnishing and other expenses, will be around Rs 65 lakh. Of this, the loan will cover only Rs 40-44 lakh. While making a big commitment like home ownership, ensure you have an emergency fund, which should ideally be six months of expenses, to avoid defaults. Home buying is rewarding but requires disciplined planning.

Also read | I am 55 years old and have Rs 50 lakh lump sum. How can I invest it to build wealth in 5 years?

I am 46, and own a house. Should I invest in a second property to generate rental income, or should I consider REITs instead?

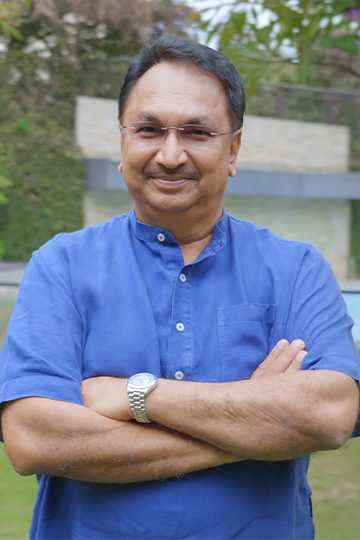

Vidya Bala Co-Founder, PrimeInvestor.in: If you look at the rental yields (rent divided by the total cost of buying a house including interest on loan), it is pretty low at 3-4%. REITs may give you slightly higher returns at 6% or more but are not guaranteed and can vary. REITs are quasi-equity instruments and come with equity risks. Much of their income comes from rent from commercial properties. So depending on your risk profile and need for fixed cash flow (whether you really need a fixed sum every month), you would need to make a call. If your only need is income, you can also use options like RBI Floating Rate Savings Bonds that deliver superior returns.

Ask our experts

Have a question for the experts? etwealth@timesgroup.com

(Disclaimer: The opinions expressed in this column are that of the writer. The facts and opinions expressed here do not reflect the views of www.economictimes.com.)

Lessons from the Grandmasters