Now Reading: Indian Budget 2024: Winners and Losers Revealed

-

01

Indian Budget 2024: Winners and Losers Revealed

Indian Budget 2024: Winners and Losers Revealed

Quick Summary

- Teh 2024 Indian Budget is highly anticipated, with potential implications for taxpayers and the economy.

- finance Minister Nirmala Sitharaman will present the budget.

- There might be revisions to tax slabs and capital gains taxes to relieve financial pressure on the middle class.

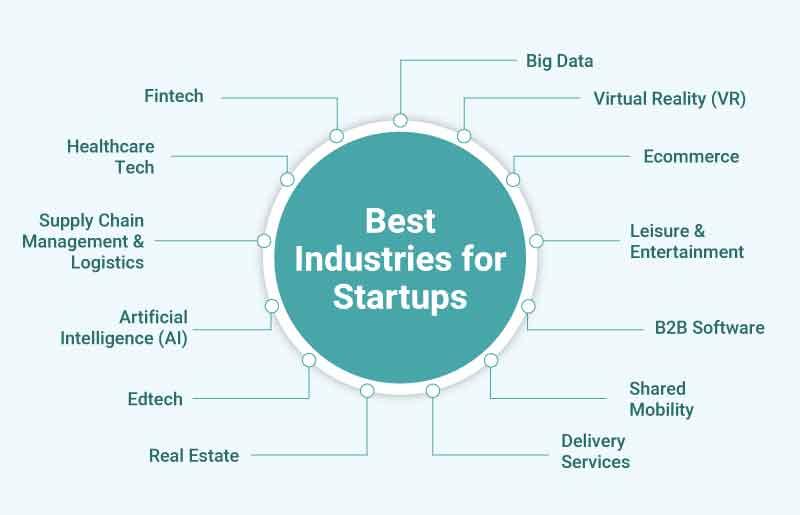

- New schemes include paid internships with top companies and favorable allocations for startups.

- Revised tax slabs could provide minor relief, but meaningful benefits are uncertain.

- Modifications in capital gains taxes may impact investment strategies; investors need to reassess their plans.

- Startups receive incentives such as tax breaks and grants, fostering growth in India’s entrepreneurial ecosystem.

class” src=”/wp-content/uploads/2025/03/6.t003.jpg” alt=”Taxation Changes and Their Impact on the Middle Class”>

Indian Opinion Analysis

The upcoming 2024 Indian Budget presents an intriguing mix of potential reliefs and challenges across different sectors. Tax slab revisions are a crucial focus that may offer minor alleviation for middle-income earners; however,ample financial improvements remain uncertain. As capital gains tax changes loom, investors must strategically adjust their portfolios, reflecting a broader economic shift.

Moreover,this budget signifies a push towards innovation by incentivizing startups through tax breaks. Such measures aim to stimulate entrepreneurship but require careful monitoring to ensure equitable distribution of benefits. The provision of paid internships reflects an effort toward bridging education-employment gaps—key steps toward equipping India’s youth with essential skills.

while promising reforms are articulated, stakeholders must stay vigilant about how these top-level plans trickle down into tangible outcomes for ordinary citizens.