Now Reading: Markets Rally and Rupee Gains as Fed Signals Boost Sentiment

-

01

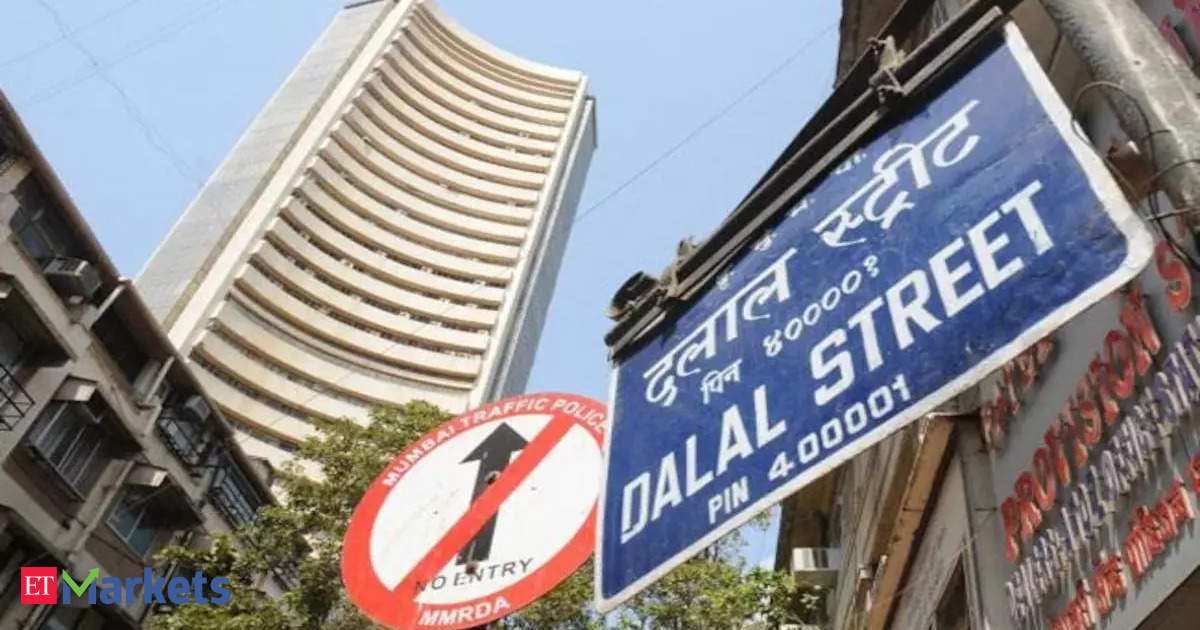

Markets Rally and Rupee Gains as Fed Signals Boost Sentiment

Markets Rally and Rupee Gains as Fed Signals Boost Sentiment

swift Summary

- india’s equity benchmarks, NSE Nifty and BSE Sensex, rose for the fifth consecutive session on Friday, recording their strongest weekly gains in four years.

- Nifty closed at 23,350.40 (+0.69%), while Sensex ended at 76,905.51 (+0.73%). Both indices gained approximately 4.3% during the week.

- Positive indicators include expectations of US interest rate cuts and renewed foreign portfolio investor (FPI) purchases totaling ₹7,470 crore on Friday alone.

- The rupee appreciated by 39 paise on friday to close at 85.98 per dollar-its best weekly performance in over two years-with a boost from stock market recovery and FPI inflows.

- Mid-cap and small-cap indices saw notable increases this week: Mid-Cap 150 index (+7.27%) and Small-cap 250 index (+8.14%),marking their highest weekly advances in five years.

- RBI interventions such as dollar liquidity support ($15 billion swaps) contributed to rupee strengthening since its all-time low of ₹87.95 per dollar in February.

- Experts attributed the rise in equity markets to oversold conditions reversing amid tactical buying linked to upcoming RBI monetary policy review and FTSE index rebalancing.

Indian Opinion Analysis

India’s equity indices displayed remarkable resilience this week amidst global uncertainties surrounding trade policies (e.g., Trump tariffs). Optimism stemming from external factors like potential US rate cuts was amplified by robust FPIs activity-a positive shift after prolonged bearish sentiment across markets.

The broader impact reflects improved investor confidence with mid-cap and small-cap stocks showing their best performance in five years; though, analysts caution that sustainability may hinge upon domestic monetary policy outcomes post-RBI review next month.

The strengthening rupee aligns with RBI’s proactive measures addressing liquidity deficits through FX swaps-underscoring how currency movement remains intertwined with economic interventions and international dynamics like corrections in the US Dollar Index.

Overall implications suggest India’s markets exhibit renewed vitality bolstered by technical pullbacks following sustained overselling periods-though future prospects might moderate depending on global developments such as reciprocal tariff deadlines or domestic earnings visibility across sectors like railways, power defense.