Now Reading: Minister Thangam Thennarasu Calls for Safeguarding State Revenue in GST Reforms

-

01

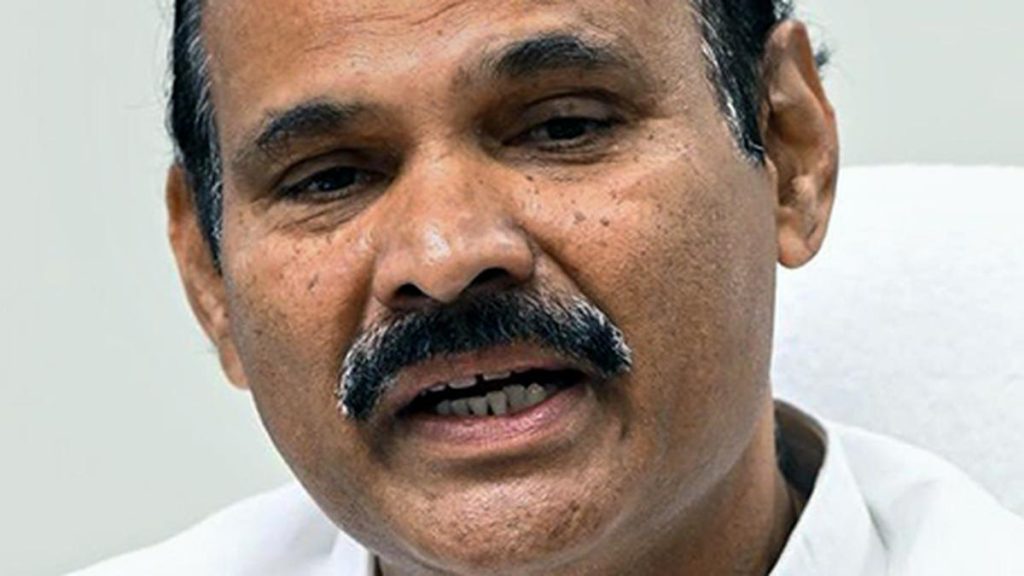

Minister Thangam Thennarasu Calls for Safeguarding State Revenue in GST Reforms

Minister Thangam Thennarasu Calls for Safeguarding State Revenue in GST Reforms

Rapid Summary

- Tamil Nadu Finance Minister Thangam Thennarasu welcomed proposed reforms in the Goods and Services Tax (GST) system.

- He participated in the GST Council’s Groups of Ministers meeting in New Delhi, addressing issues related to Compensation Cess, Health and Life Insurance, and Rate Rationalisation.

- Minister Thennarasu urged that the financial resources of States be considered while implementing tax reforms, given their reliance on revenue for infrastructure and welfare programs.

- He proposed extending the Compensation Cess to offset potential revenue losses arising from rate rationalisation.

- The Tamil Nadu government expressed its willingness to cooperate with GST rationalisation efforts but emphasized safeguarding States’ financial interests.

Indian Opinion Analysis

The concerns raised by Tamil Nadu Finance Minister Thangam Thennarasu underscore a critical tension inherent in India’s federal system: balancing national tax policy reforms with State-level fiscal autonomy. His emphasis on extending Compensation Cess points to larger anxieties among states over revenue losses that could hinder growth projects or welfare initiatives under pressure from rate rationalisation proposals. While Tamil Nadu’s readiness to cooperate suggests collaborative federalism is possible, it also highlights a need for broader measures that address state-specific fiscal dependencies without jeopardizing growth objectives under GST reform timelines.

Read more: https://example.com