Now Reading: Of course! Please provide the existing headline, and I’ll craft a concise, engaging revision for you

-

01

Of course! Please provide the existing headline, and I’ll craft a concise, engaging revision for you

Of course! Please provide the existing headline, and I’ll craft a concise, engaging revision for you

Fast Summary

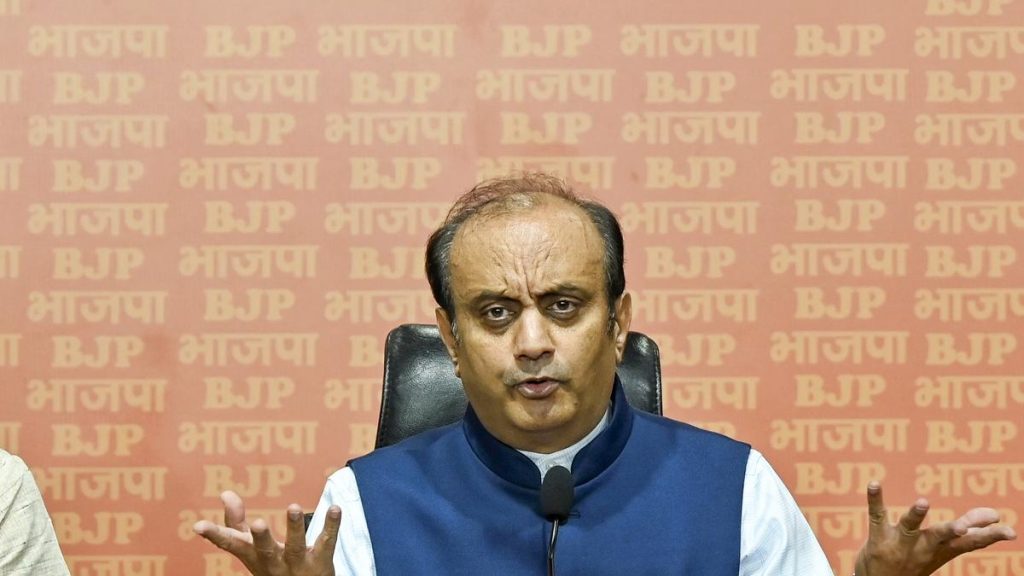

- The article discusses a development involving Kiren Rijiju and the new Income Tax bill.

- It mentions “normal parliamentary procedure,” potentially referencing how the bill’s introduction aligns with legislative norms.

- The link to NDTV’s page was restricted due to a lack of access permissions.

Indian Opinion Analysis

Without full access to the source,it remains unclear what specifics were proposed or debated about the new Income Tax Bill. However, references to adherence to “normal parliamentary procedure” might suggest efforts aimed at maintaining transparency and compliance with standard legislative practices. For India, ensuring procedural rigor in tax reforms is crucial as it upholds accountability while potentially impacting both businesses and individual taxpayers nationwide. Further details would be needed for in-depth analysis on whether this represents important policy changes or minor adjustments.

Read more: NDTV Article Access Issue