Now Reading: President Droupadi Murmu Approves Amendments to Income Tax Act

-

01

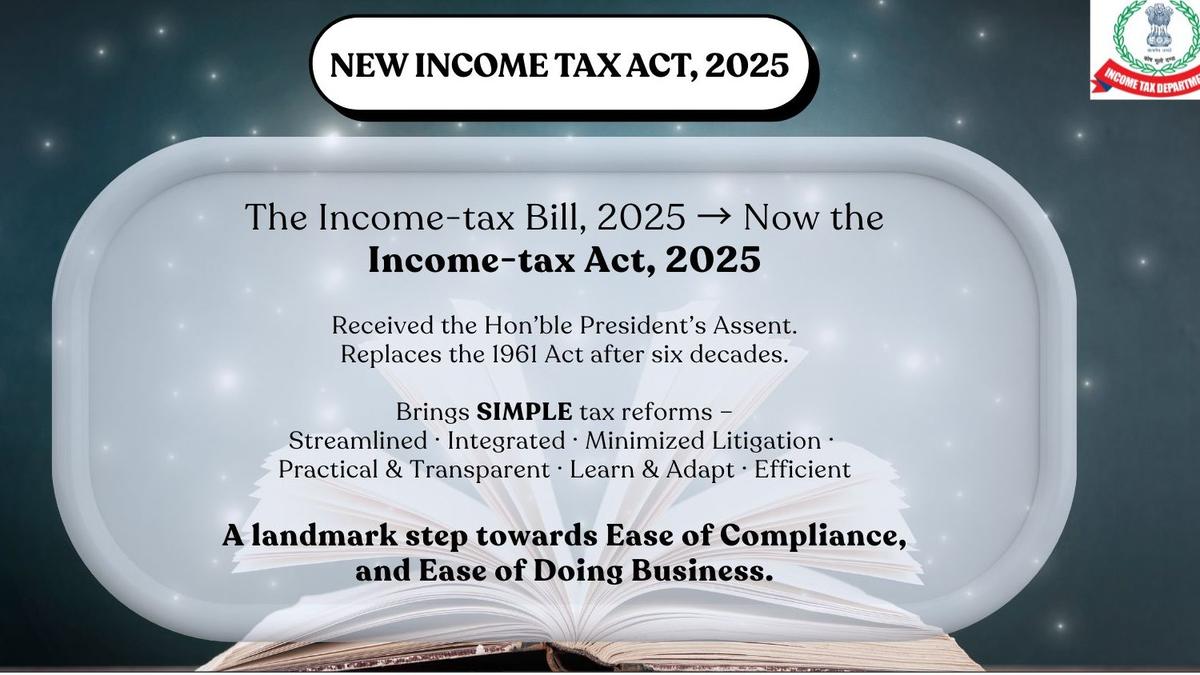

President Droupadi Murmu Approves Amendments to Income Tax Act

President Droupadi Murmu Approves Amendments to Income Tax Act

Quick Summary

- President Droupadi Murmu has given her assent too the Income-tax Act, 2025, on August 21, 2025.

- the new Act replaces the six-decade-old Income Tax Act of 1961 and will be effective from April 1, 2026.

- It aims to simplify tax laws by reducing wordage and enhancing clarity for taxpayers.

- Changes in the Income Tax Act include:

– Reduction of Sections from 819 to 536 and Chapters from 47 to 23 compared to the old law.

– Total words reduced substantially from approximately 5.12 lakh to 2.6 lakh.

– Introduction of simplified tables (39) and formulas (40) for better understanding of provisions.

- No changes in tax rates are imposed; focus remains solely on increasing simplicity, openness, and compliance ease.

source: Income Tax India tweet | Related Article

Indian opinion Analysis

The approval of the Income-tax Act, 2025 marks a significant step toward modernizing india’s taxation framework. By replacing an outdated system that had been seen as overly complex with simplified language,reduced sections/chapters,and clearer tabular representations and formulas-the government demonstrates its intent toward making tax processes more accessible. This reform could enhance ease-of-compliance among taxpayers while also reducing legal ambiguities that often lead to disputes.By avoiding changes in tax rates or introducing major policy alterations within this legislation itself-its reforms remain non-disruptive yet impactful at improving structural efficiency.For India’s economy – striving toward better governance- such steps support both transparency goals & simplification ideals without adding direct complexity burdens meanwhile enhanced simpler regulations may stimulate trust enhancements wider mood