Now Reading: RBI Announces Record ₹2.7 Lakh Crore Dividend to Government

-

01

RBI Announces Record ₹2.7 Lakh Crore Dividend to Government

RBI Announces Record ₹2.7 Lakh Crore Dividend to Government

### Swift Summary

– The Reserve Bank of India (RBI) will transfer a record Rs 2.7 lakh crore dividend to the government for this financial year, surpassing last year’s Rs 2.1 lakh crore and higher than budget estimates.

– The government projected to receive Rs 2.6 lakh crore from the RBI and other financial institutions in FY26, wich aligns closely with this payout.

– Analysts expect the payout to bring down government bond yields further.

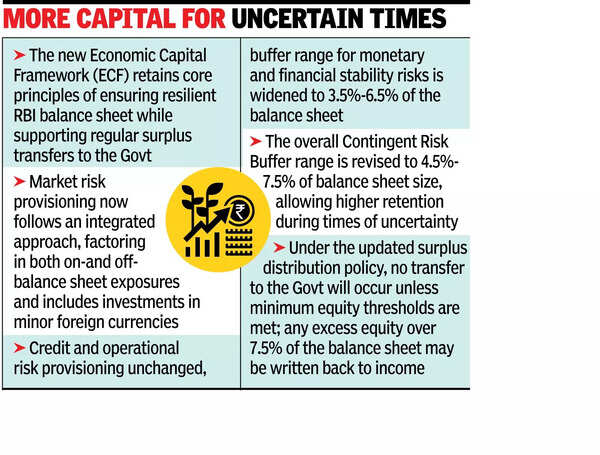

– RBI raised its contingency risk buffer from 6.5% to 7.5%,retaining more of its earnings amidst global economic uncertainty and domestic financial stability concerns.

– Surplus was driven by increased income from foreign exchange sales, improved returns on overseas assets, and gains from liquidity operations.

– Aditi Nayar (ICRA chief economist) stated that the higher dividend exceeds budget assumptions by Rs 40,000-50,000 crore (11-14 basis points of GDP), providing fiscal relief for potential shortfalls like disinvestment receipts or additional costs while keeping fiscal deficit at target levels.

– Madan Sabnavis (Bank of Baroda chief economist) expects extra resources between Rs 50,000-60,000 crore but warns such high transfers may not be sustainable annually due to market conditions.

—

### indian Opinion Analysis

The historic dividend transfer will provide near-term fiscal relief for India’s finances amidst slowing nominal GDP growth projections and potential revenue shortfalls in areas such as tax inflows or customs duties due to reduced tariffs. It underscores a strong earnings position within the central bank arising from foreign assets and liquidity management operations.

However, this payout is not without caveats-raising contingency buffers highlights RBI’s cautious stance amid uncertain global economic conditions reflective of longer-term risks. Economists rightly caution against assuming repeatability since market performance directly influences future surpluses earmarked as dividends.

From a broader perspective, this move allows room for fiscal maneuver for key governmental expenditures without compromising deficit targets-a critical aspect in uncertain economic climates but dependent on strategic utilization considering future limitations tied to annual reserves adjustments.

[read More](https://timesofindia.indiatimes.com/business/india-business/rbi-to-transfer-rs-2-7-lakh-crore-as-dividend-to-govt-a-record/articleshow/121369601.cms)