Now Reading: SpaceX Heading to Over $10 Trillion Valuation Late in 2030s

-

01

SpaceX Heading to Over $10 Trillion Valuation Late in 2030s

SpaceX Heading to Over $10 Trillion Valuation Late in 2030s

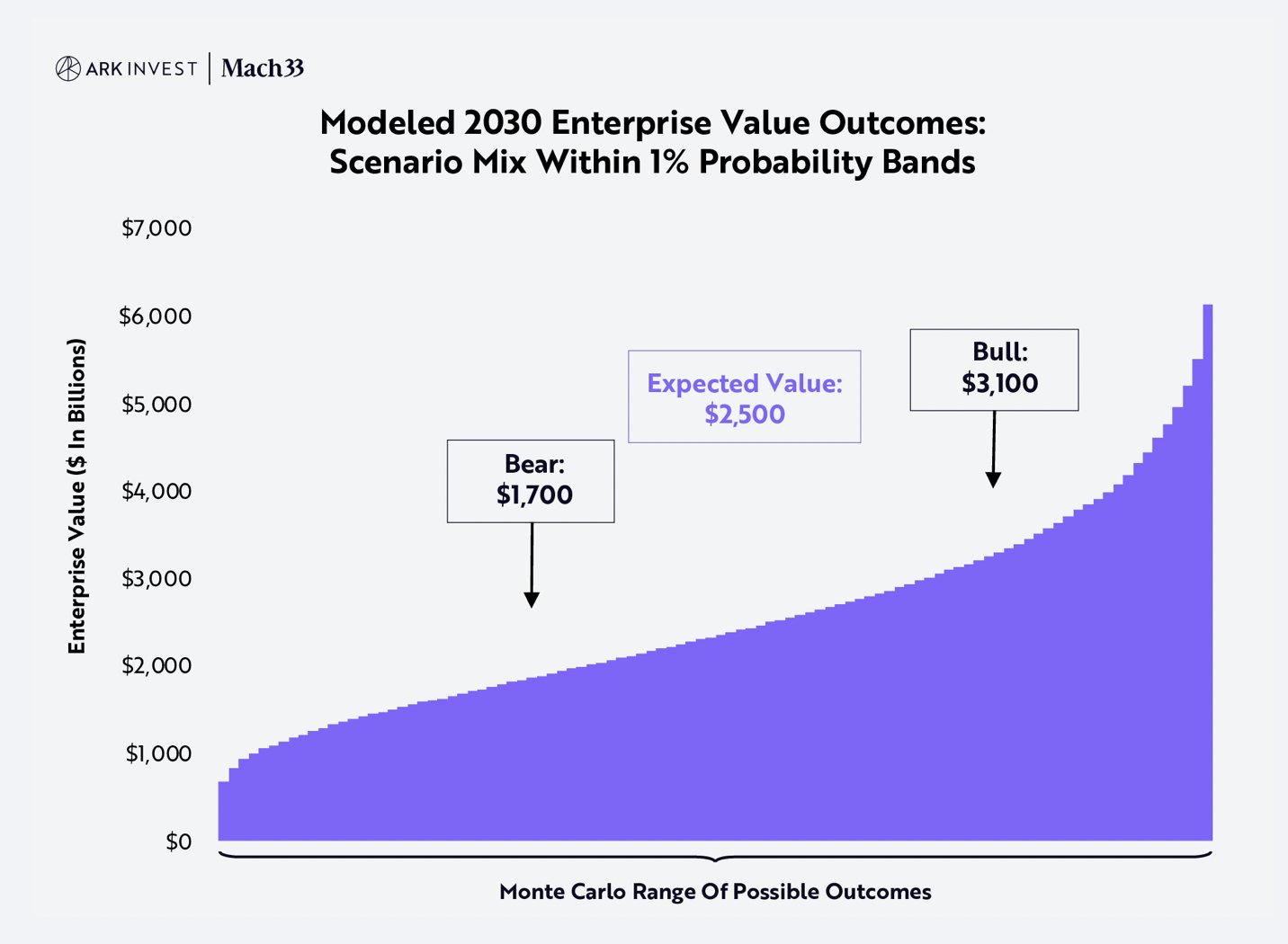

Developed in collaboration with Mach33, ARK’s open-source SpaceX model yields an expected enterprise value in 2030 of ~$2.5 trillion, generating a ~38% compound annual rate of return from its last funding round at $350 billion in December 2024.1 Tuned to the 75th and 25th percentile Monte Carlo outcomes, our bull and bear cases are ~$3.1 trillion and ~$1.7 trillion, respectively, as shown below.

Mach33 and ARK Invest have built a unified model that stress-tests thousands of ways SpaceX’s next 15 years could play out. Rather than handing down a single forecast, the model lets us peek behind the veil of uncertainty and glimpse an entire probability landscape, complete with satellite internet blanketing Earth, fleets of Starships cycling to Mars, and armies of Optimus robots assembling a frontier city.

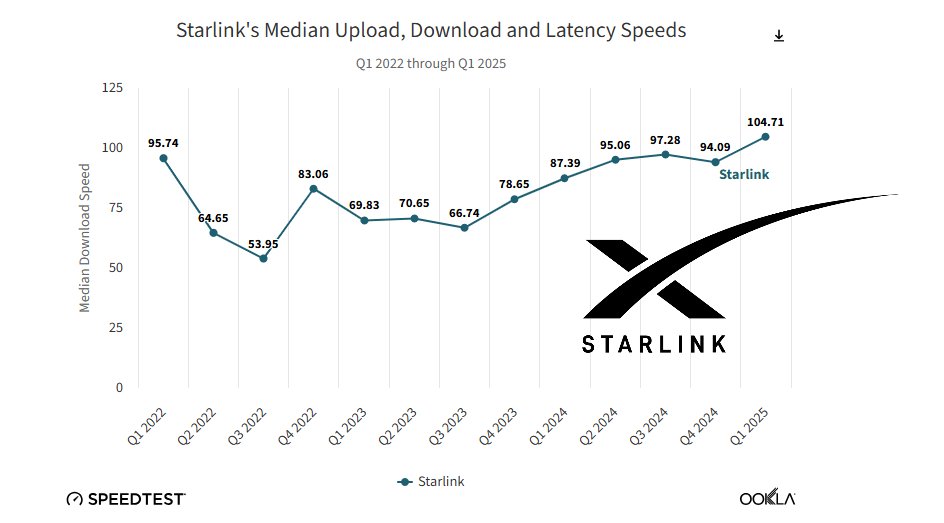

June 2025 SpaceX reports more than 6 million active connections across 140 countries – a customer base larger than many mid-tier terrestrial Internet Service Providers (ISP). In parts of rural North America and Europe it has become the the main alternative to slow Digital Subscriber Line (DSL); in cities such as Nairobi, Harare, Lagos, Lusaka, and dozens of smaller African hubs, receiver kits have sold out within days of arriving in-country, because there simply isn’t a ground network to compete with it.

The base case trajectory implies bandwidth growing ~30× in five years to 20,000 Tbps and the on-orbit mass of Starlink satellites ~13 ×. Two hardware shifts enable that slope:

Version-3 Starlink Satellites. Each V3 bus is slated for ~10× the throughput of today’s V2 Mini while costing fewer dollars and kilograms per bit to build and to launch. Note: we don’t model a discrete jump to V3 busses due to uncertainties about mass and future satellite iterations. Instead, Wright’s-law learning curves steadily ramp Gbps/kg according to historical datapoints, so performance converges on “V3-level” capacity, and beyond, over time rather than in one step.

Starship. A single Starship launch, expected to carry ~60 V3 satellites at ~1 Tbps each, would loft about 60 Tbps of fixed-satellite-service (FSS) capacity. One Starship ≈ 22 Falcon 9 launches in bandwidth terms.

The “Mars Launch Scaling” chart above captures that pivot in two synchronized sweeps of the same x-axis:

Falling marginal cost/kg (pink, left scale): The curve starts near $13k per kilo in 2025, when Starship is still effectively expendable. From there it glides downward as reuse cycles stack up. By the mid-2030s the cost per kilogram is well below four figures; by the 2040s it approaches the few-hundred-dollar range that makes bulk interplanetary cargo viable.

Rising Starship departures (blue spikes, right scale): Those spikes mark Mars–Earth transfer windows. In the base case the first trickle is a handful of ships in 2029. However, as free cash flow snowballs, each window opens wider climbing to roughly ~2,000 Starships by the ~2040 windows. Note that we are treating test flights to Mars as R&D, while the trips in the chart above are production-grade missions aimed at establishing infrastructure and capturing economic value on the planet.

The result may be that a fleet of Starships assembling for trans-Mars injection stops looking like science-fiction spectacle and starts reading as an economic inevitability. The model suggests 2000 Starships to Mars per window in 2040, going up to 20,000 per window if you extrapolate the trend to 2050. Even at 20,000 ships per window, the cadence is modest next to Earth’s 40 million annual commercial flights or its 100,000-strong merchant-ship fleet; humanity would still be in the earliest phase of interplanetary commerce. The slope is unmistakable: once Mars launch costs crack the three-digit barrier and the cash engine behind them has passed peak compounding, the model’s logical next step is to send flotillas, not test vehicles, towards the untapped Martian market.

Nextbigfuture Projects AI Data Centers on Mars

Why does Mars matter?

Astrophysicist Peter Hague’s essay “Why Mars” crystallises the case for the Red Planet, and it dovetails perfectly with our Monte-Carlo upside.

Untapped photons, ready industry. Mars captures ~12 % of Earth’s total sunlight, or ~40 % of the energy that hits Earth’s land, but uses virtually none of it today. That’s a vast, relatively free power budget sitting on top of iron-rich regolith and other easily mined raw materials.

Energy-arbitrage at planetary scale. Hague argues that humanity is already, in effect, a Type I civilization on the Kardashev scale; every photon on Earth is spoken for, either by industry or ecosystems. Mars offers a blank slate where industrial use doesn’t crowd out a biosphere, letting civilization keep scaling without the environmental trade-offs that cap growth on Earth.

Cheaper to climb, cheaper to ship. With a 5 km/s escape velocity (vs 11.2 km/s on Earth), every kilo launched from Mars costs a fraction of the Δv. Thanks to the exponential rocket equation, cutting Δv almost in half collapses the required propellant-to-payload mass ratio from about 15:1 on Earth to ~4:1 on Mars. In practical terms, that slashes propellant (and therefore launch) cost by roughly 4-to-5× per kilogram. Once Starship closes the loop, Mars becomes the lowest-cost springboard for pushing deeper into the solar system, and, far enough in the future, could become a competitive export hub that supplies Earth itself.

Why model Optimus robots instead of people?

Single, measurable proxy. Human labour would force the sheet to track salaries, life-support overhead, and an unwieldy catalogue of task-specific tools. We sidestep that complexity by expressing all surface productivity in one fungible unit: a Mars-adapted Optimus robot. Pricing each robot at the discounted cash-flow of its lifetime output lets the model capture Mars-side economic value without itemising every activity or sub-asset it eventually touches.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.