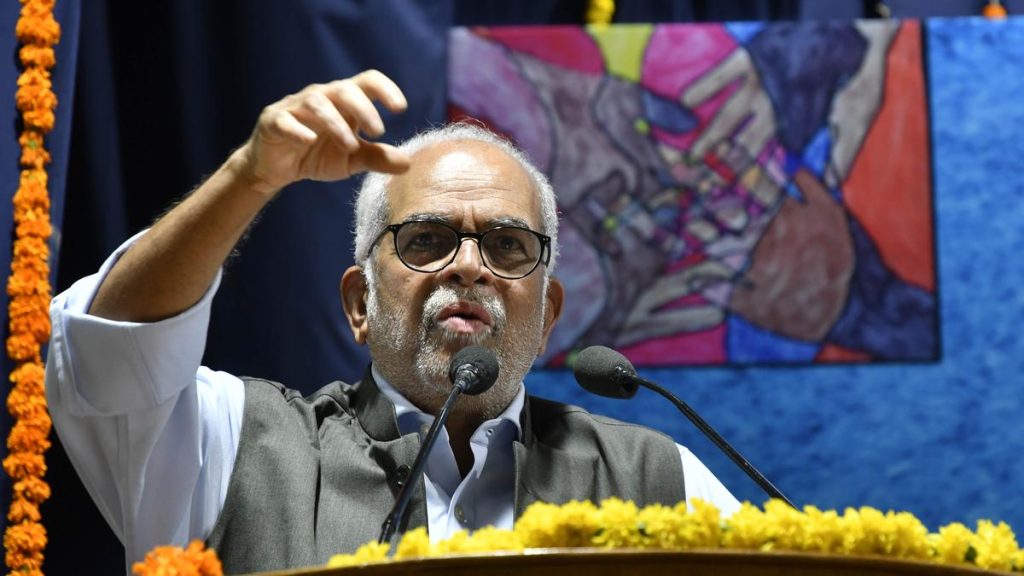

Now Reading: Structural Downside Unlikely, Says Mayuresh Joshi

-

01

Structural Downside Unlikely, Says Mayuresh Joshi

Structural Downside Unlikely, Says Mayuresh Joshi

Fast Summary

- Economic Outlook: Marketsmith IndiaS Head of Equity, Mayuresh Joshi, expressed optimism about the Indian economy. Key factors include an upgrade in India’s sovereign rating by S&P and anticipated rationalization of GST rates.

- External Investments: Joshi believes Foreign Portfolio Investors (FPIs) and Foreign Direct Investments (fdis) will return to India in the coming months due to strong domestic flows, improving earnings, and favorable market positioning amidst global trade uncertainties.

- Consumption & Earnings Growth: GST rationalization is expected to boost consumption significantly. This aligns with positive expectations on corporate earnings recovery from the second half of the year.

- Steel Sector Dynamics: The government plans to extend safeguard duties on steel imports from China and vietnam for three years. The phased structure starts at 12% in Year 1 before tapering to 11%.

- Impact on Steel Industry: While this measure protects domestic producers and enhances private capital expenditure growth (“green shoots”), global pricing uncertainties may limit price pass-through domestically.

Indian Opinion Analysis

Mayuresh Joshi’s analysis underscores India’s resilience amid global economic challenges by highlighting strong internal market dynamics and strategic potential for foreign investments. The anticipated boost from GST rationalization could address one key pain point-consumption-which is central to broader economic recovery.

The extension of steel safeguard duties reflects a policy-level focus on supporting domestic industries against unfair competition while fostering internal capital expansion. However, reliance on volatile international steel prices raises concerns about sustained competitiveness.

these elements collectively position India as a stable investment destination but also underline fiscal discipline challenges if revenue implications from measures like GST rate cuts are not managed prudently. Balancing immediate consumption stimulus with long-term structural reforms will be critical for sustaining investor confidence.