Now Reading: Trump’s Tax Bill: How It Could Affect Your Income and Finances

-

01

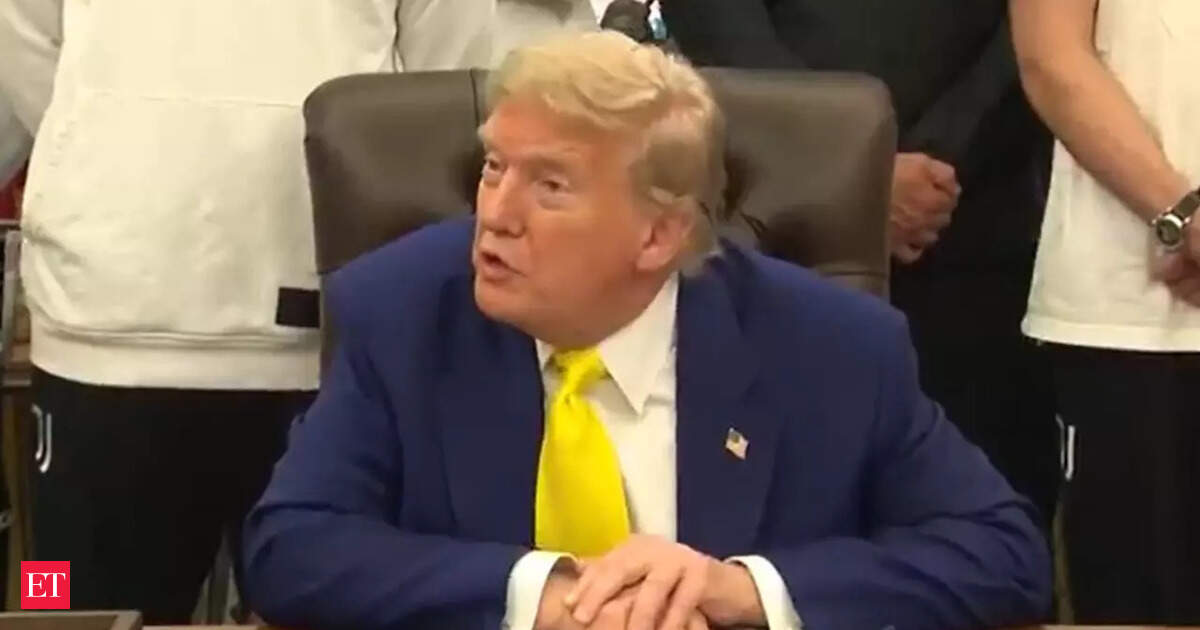

Trump’s Tax Bill: How It Could Affect Your Income and Finances

Trump’s Tax Bill: How It Could Affect Your Income and Finances

Quick Summary:

- The article discusses notable impending changes to income tax laws under former U.S. President Donald Trump’s governance. These reforms aim to impact individual wallets adn income taxes.

- Labelled as “Trump’s Big Beautiful Bill,” the proposed legislation includes wide-ranging tax policy adjustments.

- Specific details regarding how these changes could effect taxpayers globally, including potential implications for Indian professionals working in the U.S., are mentioned alongside possible economic repercussions.

Indian Opinion Analysis:

The proposed U.S. tax reforms could influence global financial dynamics, particularly for Indian expatriates and professionals engaged in America’s tech and healthcare sectors. Tax incentives or deductions might alter disposable incomes while impacting remittance trends back to India. changes in corporate taxation under this bill could also indirectly affect outsourcing firms that rely on robust American client markets. For India, it will be essential to monitor these developments closely as they may not only affect economic relations but also the livelihood of its citizens engaged overseas.